Texas Divorce / Texas Child Support Q and A

Q: How long is the divorce process?

A: In a Texas divorce there is a waiting period of a minimum of 60 days from the time you file the Original Petition commencing the lawsuit to the time the divorce may be finalized. Few divorces are finalized in this time-period. It is more likely that an uncontested divorce will take approximately 3 to 6 months and a contested divorce will likely will take much longer depending on the issues and conduct of the parties.

Q: Do my spouse and I both have to hire attorneys?

A: No. But it is certainly in your best interest to hire an attorney for a consultation purposes and to review legal documents for your own protection. An attorney should not in the vast majority of cases represent both parties, so if one attorney is involved he or she will under law be looking out for the best interest of the client that hired him/her, while the other party is representing themselves (pro se).

Q: Will I have to go to court?

A: If the spouses reach agreement, one party will have to appear in Court. Often times, when the parties have worked out their own settlement, that agreement is signed by each of you and submitted to the court with only one party making a personal appearance to state to the Court that the agreement has been reached and to establish statutory requirements. If, on the other hand, you and your spouse cannot come to an amicable settlement through this process, you will both have to appear in court, and often on many occasions.

Q:Should I Move Out of the Marital Residence?

A: Be sure to consult with an attorney before leaving the marital residence. Leaving the home may be viewed as abandonment or actually declaring a new residence, especially if you are taking personal items with you (clothing, automobile, sentimental possessions, etc.). If children are involved issues may arise as to who currently has or should have primary possession of the children. Once you have voluntarily left the home, it may be difficult to move back in or obtain orders for primary or temporary possession.

Q:How Do I Get a Divorce?

A: Before getting divorced you or you and your spouse should decide that you absolutely want and need the divorce. Even though in the divorce process prior to final judgment everything is reversible, it is important that you realize that the road is sometimes very long and can be a difficult one to travel.

Q:What if I Do Not Want a Divorce?

A: The advent of a divorce is something that slowly builds. You may want to consult with your spouse about placing things on hold while you receive counseling. However, the need for a divorce is rarely something that happens over night. Your spouse may have made his or her mind up long ago that divorce is the only option. If your spouse has filed for divorce, you have no choice. The most important thing for you to do if your spouse has filed for divorce is promptly seek proper legal advice.

If your spouse has significant assets and you feel they may be considering divorce seek legal advice immediately. You may want to do some pre-planning to make sure you have complete copies of original and final documents and know where all the marital assets are located and to assure their status. Do not give your spouse time to stash, spend away and/or hide assets.

Q:Can You Modify Child Support Orders?

A: Making changes to an existing child support order is not uncommon. Most states will not allow a request for modification on a child support order unless a time-period (of 2 to 4 years depending on the state) has passed since the order was put into place. Keep in mind that child support orders cannot be increased or decreased on a whim. In Texas, you must show a change in circumstances. However, if the person paying child support’s income has gone up or down more than 25% you can request a change. IMPORTANT NOTE: If you agree to no child support in your first order (Final Decree) and your spouse has a significant income at that time, you may have waived a statutory right to future child support unless the income level at the time of the existing order increases or decreases significantly.

Q:Can I Deny My Ex-spouse Visitation, Possession or Access?

A: You can not and should not deny visitation or possession, unless the Court has modified the visitation or possession to allow it! Denying visitation or possession is one of the biggest mistakes made by most primary custodial parents – it is an act of contempt in Texas. You may believe you have a justifiable reason for denying the visitation or possession rights, but by law your are not permitted to do so absent extraordinary circumstances, usually involving gross neglect or physical abuse.

Q:How Do I Get Custody of My Child(ren)?

A: The first and most important step to getting custody of your child(ren) is to be an involved and hands-on parent and to be honest. Being a great parent is not always the easiest task during divorce, but it is important to carefully consider each and every action you take during a divorce and how it may or may not effect the child(ren). You will also need good legal representation. Child custody issues can become ugly and complicated no matter how good your intentions may be. Make sure you are prepared. Document everything.

Q:What if I Do Not Like the Judges Decision?

A: The purpose of the ruling is to establish what exactly should be stated in the Final Divorce Decree. Once the attorneys have drafted the Final Divorce Decree and both parties have agreed that it coincides with the ruling, it will be presented to the Judge for signing. Once the parties have agreed and signatures are signed, you will have to live with the decisions. If the divorce is highly contested and the Judge rules and you are unhappy with the results, you have only a small window to appeal the decision or request a new trial.

Q:What is Fair Spousal Support or Alimony?

A: If you and your spouse can not come to agreement on the need for or amount of spousal support to be paid, the length of time, and under what conditions, the spousal support will most likely be set by a Judge according to Texas law.

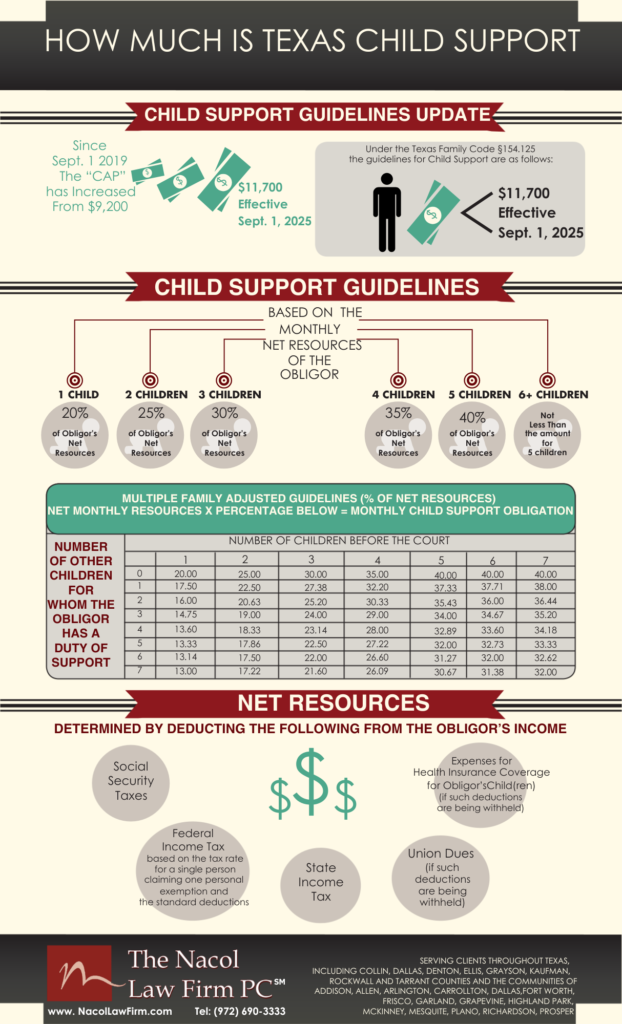

Q:How Much is Child Support?

A: See Graphic below and also read our blog on Texas Child Support Guidelines

Dallas Divorce Attorney

Julian Nacol

Nacol Law Firm P.C.

Call (972) 690-3333

A Domestic Violence Abuser – Look for these serious warning signs

If you are a Victim of Domestic Abuse, you must fight back! No one has the legal right to physically, mentally, or verbally abuse another individual! If you are a relative, friend or acquaintance of a potential victim or victims, please look for warning signs of abuse being committed on these people, asset legal defense on this conduct, and report your findings to the police.

Often victims are so mentally and verbally abused, they do not have the strength to defend themselves or their family. Truly be a friend and help to protect their lives by reporting any fact based suspicion of abuse to the proper authorities.

Some warning signs to look for in an abuser or a potential abuser’s conduct in a relationship:

Push for Quick involvement

A victim often has known or dated the abuser for a brief period of time before getting engaged or living together. The abuser pressures the victim for an exclusive commitment immediately.

Jealousy & Controlling Behavior

An abuser will equate jealously with love and controlling behavior to concern for the victim. The abuser becomes jealous of time spent with others. The abuser may call the victim frequently during the day, drop by unexpectedly, refuse to let the victim work, check the car mileage, or ask friends to watch the victim. As the behavior progresses and the situation worsen, the abuser may assume all control of finances or prevent the victim from coming or going freely.

Unrealistic expectations

An abuser expects the victim to be the perfect partner, and to frankly, without error, meet his or her every need.

Isolation

An abuser will attempt to isolate the victim by severing the victim’s ties to outside support, relationships, and resources. The batterer will accuse the victim’s friends and family of being “trouble makers.” The abuser may block the victim’s access to use of a phone, car, and also discourage the victim from working. No outside contact with the rest of the world.

Playing the Victim

An abuser will blame and project upon others for all problems shortcomings. Someone is always out to get the abuser or is an obstacle to the abuser’s achievements.

Blames others for feelings

An abuser will use feelings to manipulate the victim. Common phrases to look for: “You’re hurting me by not doing what I want.” “You control how I feel.”

Hypersensitivity

An abusive person is easily insulted, claiming hurt felling when he or she is really mad.

Cruelty to animals or children

This is a person who punishes animals brutally or is insensitive to their pain. The abuser may also expect children to perform beyond their capability and use physical force if a child cannot comply. 65% of abusers who beat their victims will also abuse children.

“Playful” use of force in sex

This behavior includes restraining partners against their will during sex, acting out fantasies in which the partner is helpless, initiating sex when the partner is asleep, or demanding sex when the partner is ill or tired. The abuser may also find the idea of rape exciting.

Verbal abuse

Constantly criticizes or says cruel things, degrades, curses, or calls the victim bad names. Sleep deprivation could be involved with relentless verbal abuse.

Rigid sex roles

The abuser will expect the victim to serve, obey and remain home to serve on the abuser

Sudden Mood Swings

Explosive behavior and moodiness, which can shift quickly from sweet to violent in minutes.

Past battering

An abuser will beat any partner if the individual is involved with the abuser long enough for the cycle of abuse to begin.

Threats of violence

This consists of any threat of physical force meant to control the partner. Most people do not threaten their mates but an abuser will excuse this behavior by claiming “everyone talks like that.”

Physical force during an argument

This may involve an abuser holding down the victim, blocking escape routes and physically restraining the victim from leaving, pushing or shoving. Holding someone back in order to make demands, such as “You will listen to me!” is also a show of force.

Will Contest

The requirements for testamentary capacity are minimal. Some courts have held that a person who lacks the capacity to make a contract can still make a valid will. While the wording of statutes or judicial rulings will vary from one jurisdiction to another, the test generally requires that the testator was aware of:

• The extent and value of their property

• The persons who are the natural beneficiaries

• The disposition he is making

• How these elements relate to form an orderly plan of distribution of property.

The legal test implies that a typical claimant in a will contest is a disgruntled heir who believe he should have received a larger share than what he received under the will. Once the challenging party meets the burden of proof that the testator did not possess the capacity, the burden subsequently shifts to the party propounding the will to show by clear and convincing evidence that the testator did have the requisite capacity.

Duress or coercion (as a term of jurisprudence) is a possible legal basis to set aside or otherwise modify a will, in that, the execution of the will by the Testator/Testatrix arises out of an immediate fear of injury. Black’s Law Dictionary (6th ed.) defines duress as “any unlawful threat or coercion used… to induce another to act [or not act] in a manner [they] otherwise would not [or would].”

To establish duress, four requirements must be met:

• Threat must be of serious bodily harm or death

• Harm threatened must be greater than the harm caused by the crime

• Threat must be immediate and inescapable

• The defendant must have become involved in the situation through no fault of his or her own

A person may also raise duress when force or violence is used to compel him to enter into a contract, or to discharge one.

Depending on the grounds, the result may be:

• Invalidity of the entire Last Will and Testament, resulting in an intestacy.

• Invalidity of a clause or gift, requiring the court to decide which charity receives the charitable bequest, using the equitable doctrine of cy pres

• Dimunition of certain gifts, and increase of other gifts to the widowed spouse or orphaned children, who would now get their elective share.

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite 1190

Dallas, TX 75231

Metro: 972-690-3333

Toll Free: 866-352-5240

Fax: 972-690-9901

www.NacolLawFirm.com

The Usefulness of a Revocable Trust

A trust can be a useful tool in disbursing your estate during and after death. It is hard to consider one’s mortality but when you do finally accept that death is inevitable, it is prudent to have a dispositional scheme set up that will benefit your family. A Revocable Trust is a less complicated and more expeditious way for your heirs to divide and distribute your estate according to your own specific plan once you have passed.

A Revocable Trust is a legal entity created by an individual that is used to disburse an individual’s estate avoiding significant probate court involvement. The Settler is the individual who sets up the trust and places limitations on what the trust can or cannot do with trust assets. The Trustee is the person in charge of the trust and who has a fiduciary duty to the Settlers and Beneficiaries to distribute the estate in accordance with the limitations set forth by the Settler. The Settler, in some instances, may be the Trustee as well. A Settler may not be the beneficiary of a Trust.

A Settler may also be the Trustee and is given the power to change the trust in many ways. Under Texas Property Code 122.033 a Settler that is also the Trustee reserves such powers as:

- Making a beneficial life interest for himself;

- The power to revoke, modify, or terminate the trust in whole or in part;

- The power to designate the person to whom or on whose behalf the income or principal is to be paid or applied;

- The power to control the administration of the trust in whole or in part;

- The right to exercise a power or option over property in the trust or over interests made payable to the trust under an employee benefit plan, life insurance policy , or otherwise; or

- The power to add property or cause additional employee benefits, life insurance, or other interests to be made payable to the trust at any time.

The important point is that Texas allows an individual to both make a trust and control the Trust.

A Revocable Trust can used to bypass the court system thus producing a quick and effective means for an estate to be disbursed. Instead of probating a will and having the court get involved which is timely, an individual may create a trust with limitations which can bypass the court process altogether.

The creation of a Trust can be a complex process depending on the size of the estate. An experienced estate lawyer should be consulted to ensure the Settler’s limitations set upon the Trust are valid and precise. By utilizing a Trust rather than a Will or Intestate Succession, an individual can avoid undue delay in probating the estate and the Trust itself allows the Settler the ability to specify the exact conditions and limitations that will be involved as the estate is disbursed.

NACOL LAW FIRM P.C.

8144 Walnut Hill Lane

Suite 1190

Dallas, Texas 75231

972-690-3333

Office Hours

Monday – Thursday, 8am – 5pm

Friday, 8:30am – 5pm

OUR BLOGS

SEARCH

JOIN OUR NETWORK

Attorney Mark A. Nacol is board certified in Civil Trial Law by the Texas Board of Legal Specialization