Preventing Custodial Parent From Relocating Children Out of State

Mom and Dad are divorcing or have been divorced and are now sharing joint custody of their children in the same city in Texas. One parent receives a letter from the other parent’s attorney requesting that this parent be allowed to relocate the children to another state so he/she may take a better job position with another company! This is a dilemma no parent ever wants to experience! Child Custody cases involving interstate relocation jurisdiction issues cause much heartache and are costly legal battles.

What can a Parent do to protect themselves from children being relocated away from the non-moving parent to another state without her/his consent? How may this affect the parent’s relationship with the children?

The Texas Family Code 153.002 Best Interest of Child states “The best interest of the child shall always be the primary consideration of the court in determining the primary consideration of the court in determining the issues of conservatorship and possession of and access to the child.”

The Texas Family code does not elaborate on the specific requirement for modification in the residency-restriction context, and there are no specific statutes governing residency restrictions or their removal for purposes of relocation. Texas Courts have no statutory standards to apply to this context.

The Texas Legislature has provided Texas Family Code 153.001, a basic framework on their public policy for all suits affecting the parent-child relationship:

-

The public policy of this state is to:

-

Assure the children will have frequent and continuing contact with parents who have shown the ability to act in the best interest of the child;

-

Provide a safe, stable, and nonviolent environment for the child;

-

Encourage parents to share in the rights and duties of raising their child after the parents have separated or dissolved their marriage.

How does The State of Texas treat an initial Child Custody determination?

Texas Family Code 152.201 of the UCCJEA states, among other things, that a court may rule on custody issues if the Child:

*Has continually lived in that state for 6 months or longer and Texas was the home state of the child within six months before the commencement of the legal proceeding.

*Was living in the state before being wrongfully abducted elsewhere by a parent seeking custody in another state. One parent continues to live in Texas.

*Has an established relationship with people (family, relatives or teachers), ties, and attachments in the state

*Has been abandoned in an emergency: or is safe in the current state, but could be in danger of neglect or abuse in the home state

Relocation is a child custody situation which will turn on the individual facts of the specific case, so that each case is tried on its own merits.

Most child custody relocation cases tried in Texas follow a predictable course:

-

Allowing or not allowing the move.

-

Order of psychological evaluations or social studies of family members

-

Modification of custody and adjusting of child’s time spent with parents

-

Adjusting child support

-

Order of mediation to settle dispute

-

Allocating transportation costs

-

Order opposing parties to provide all information on child’s addresses and telephone #

Help to Prevent Your Child’s Relocation in a Texas Court by Preparing Your Case!

-

Does the intended relocation interfere with the visitation rights of the non- moving parent?

-

The effect on visitation and communication with the non-moving parent to maintain a full and continuous relationship with the child

-

How will this move affect extended family relationships living in the child’s current location?

-

Are there bad faith motives evident in the relocating parent?

-

Can the non-moving parent relocate to be close to the child? If not, what type of separation hardship would the child have?

-

The relocating parent’s desire to accommodate a new job, spouse, or other criteria above the parent-child relationship. A Parent’s personal desire for move rather than need to move?

-

Is there a significant degree of economic, emotional or education enhancement for the relocating parent and child in this move?

-

Any violation of an order or prior notice of the intended move or a temporary restraining order

-

Are Special Needs/ Talents accommodated for the child in this move?

-

Fear of child and high cost of travel expenses for non-moving parent or child to visit each other to be able to continue parent- child relationship.

-

What other Paramount Concerns would affect the child concerning the relocation from the non-moving parent?

At the Nacol Law Firm PC, we represent many parents trying to prevent their child from relocating to another city or state and having to experience “A Long Distance Parental Relationship” brought on by a better job or new life experience of the relocating parent! We work at persuading courts to apply the specific, narrow exceptions to these general rules in order to have child custody cases heard in the most convenient forum in which the most qualifying, honest evidence is available; cases where the child’s home state or other basic questions are clarified, and cases where a parent has the right in close proximity with their child regardless of other less important factors.

A Director’s Fiduciary Duty to His Corporation

A Director of a Corporation has specific fiduciary duties that precludes activities that might endanger the Corporation. The certificate of formation may limit or eliminate personal liability of Directors in certain respects such as money damages but there are some concrete fiduciary duties that cannot be dispensed with such as:

- Breach the duty of loyalty;

- An act or omission not in good faith that constitutes a breach of a duty or involves intentional misconduct or a knowing violation of law;

- A transaction in which the director received an improper benefit; or

- An act or omission for which liability of a director is expressly provided by Texas Statute.

Of all the mandatory fiduciary duties listed above, the duty of loyalty is the most sacred. The policy in Texas is that a Director’s loyalty is to the Corporation first and to himself second. A Director is generally precluded from entering into any transaction that may personally benefit him. A Director has a personal interest in a transaction if he is a party to the transaction, has a material financial stake in the transaction, or is an immediate family member to the transaction.

A Director may enter into a transaction with the corporation that personally benefits him with these three exceptions:

- The material facts of the relationship governing the transaction are known to the board of directors, and the board in good faith authorizes the transaction by a vote of a majority of the disinterested directors;

- The material facts of the relationship governing the transaction are disclosed to the shareholders who then by vote approve the transaction in good faith; or

- The transaction is fair to the Corporation at the time it is authorized or ratified by the board of directors or shareholders.

If one of these three exceptions apply to a Director that stands to personally benefit from a transaction with the Corporation, then his fiduciary duty of loyalty will likely not be breached. The duty of loyalty is the most important fiduciary duty because many Corporations have Directors which serve concurrently as Directors for other independent Corporations. It is common to have a Director for a Corporation that is also a Director for another Corporation. With one individual sitting as a Director on multiple Corporations it is important that his duty of loyalty remains consistent with each Corporation that he represents.

Julian Nacol, Attorney The Nacol Law Firm P.C. (972) 690-3333

The Pitfalls of Pro Se Representation

Pro se is a Latin term meaning “for oneself” or “on one’s own behalf.” To represent oneself pro se means to advocating for one’s own self before a court, rather than being represented by counsel. The right of a party to a legal action to represent his or her own cause has long been recognized in the United States, and even predates the ratification of the Constitution. But is this the wisest course of action?

According to National Center on State Courts, 71% of domestic relations (family law) cases have at least 1 unrepresented party. In 18% of cases both parties are pro se litigants. So where does the problem lie when a litigant decides to walk into a courtroom without proper legal representation? The simple fact is that the vast majority of pro se defendants lose their cases.

The following is a quote from a judge used against a Defendant who represented himself after murdering his girlfriend. “You don’t know how to ask a question…You don’t know how to offer things into evidence. You keep making stupid speeches. You keep saying you are good at this. You are not… I do not say this to insult you…You do not know the law.”

What’s important to highlight from the judge’s speech is that it really underscores the greater reason why it is tough for a party to represent themselves in court. Poor representation is likely to antagonize a judge. Being a lawyer in the United States requires a vast amount of knowledge regarding proper legal rules and court procedures. Areas of knowledge like the federal rules of evidence, state rules of civil procedure, and local rules of court are generally very foreign and unnatural concepts to a pro se litigant. However, these were created for reasons of fair, speedy, and efficient justice.

The justice system is designed, in large part, for the traditional full representation model. Virtually all aspects of the system, from the rules to the training of judges and court staff to the physical layout of the courthouses themselves, have been oriented to cases in which knowledgeable attorneys represent the parties. The ability of a party to proceed without an attorney in prosecuting or defending a civil action is largely a matter of state law, and may vary depending on the court and the positions of the parties.

Pro se appearances may delay a trial proceeding and enhance the possibility of a mistrial and a subsequent appeal. Pro se litigants are not entitled to an award of attorney’s fees. However, a Court may order a pro se litigant to pay the attorney’s fees for the opposing party.

In some instances, pro se representation is not allowed. A pro se litigant may not represent a corporation, as a corporation is considered a “person” separate and distinct from its officers and employees. A non-lawyer may not sign and file a notice of appeal on behalf of a corporation. Similarly, a pro se litigant may not act as a class representative in a class action proceeding. In other words, a pro se litigant may not bring a class action lawsuit.

Another situation in which appearance through counsel is often required is in a case involving the executor or personal administrator of a probate estate. Unless the executor or administrator is himself an attorney, he is not allowed to represent himself in matters other than the probate.

Few federal courts of appeals allow unrepresented litigants to argue, and in all courts the percentage of cases in which argument occurs is higher for counseled cases.

Legal forms are becoming increasingly available on-line. However, numerous problems arise when deciding to use online forms and services. More often than not, these services do not take into account specific state laws. Only an attorney authorized to practice law in a specific state can effectively advise a party regarding the various jurisdictional issues that may affect their case. Many states have varying requirements when it comes to witnesses, discovery, case experts, and specific language that must be included in legal forms. Failure to comply with state requirements may lead to a case being dismissed by the court and increase future litigation expenses.

While a party has the right to represent themselves pro se in a court of law, they should not expect any special treatment, help, or attention from the court. And enough importance cannot be placed on the fact that they must comply with the Rules of the Court, even if they are not familiar with them.

Perception is everything. Representing oneself pro se can send out all the wrong signals to a judge and/or jury: that a party is not taking the matter seriously, determined to be obstructive, penny-pinching, unwilling to compromise, believe they are right and cannot maintain a proper relationship with counsel, or just downright difficult. Is this really the impression you want the court to have?

It will probably come as no surprise that the most common excuse for not employing a lawyer is that one cannot afford it. That may be short sighted. A good lawyer ought to be able to achieve a result that is fairer and of better value than a litigant struggling to do so on their own. Add to that the possibility that failure to understand and comply with court orders may result in orders for costs being made against the pro se party and the numbers start to mount up. It’s also the lawyer’s job to try to broker a settlement in order to avoid the expense of protracted proceedings and a costly trial. Trying to negotiate a settlement without proper legal counsel may end in disaster.

High Asset Divorces: Separate Property Real Estate Q&A

It is important to know what happens to your homestead residence if it was purchased prior to marriage and other assets formed into a trust before marriage without a prenuptial agreement.

Question: If an individual has a prior separate property residence, does the individual retain all interest in their property.

Answer: Yes, the separate property owner shall retain all interest including increase in value but certain exceptions apply.

Exceptions such as reimbursement claims for time, toil, and effort, payment of debt, and improvement of property may be granted to the spouse as an offset or an award. One example is if the community property income during the marriage paid down the note of the separate property, then the spouse shall be entitled to ½ of the equity paid during the time of the marriage, but not the interest paid.

Question: If an individual gets divorced can the Court force sale his separate property?

Answer: Generally, no. If the property is a homestead then there is an added protections. A court generally cannot force partition another individuals property, but there the years there have been multiple exceptions to which trial judges attempt to infringe on an individual’s separate property rights.

First, if property is purchased prior to marriage it likely be classified as separate property. The owner of the house must insure that during the marriage the individual does not place the spouse on the properties deed, nor refinance the house with the house. If an individual does this be costly, painful, but necessary. Many other factors such as summary judgements or motions to exclude may increase fees. It is important to be confident with your attorney and find a firm that has experience with higher assets cases to insure the flow and strategy of the litigation fulfills your goals.

Question: How can I protect my separate property residence from forced sale or other exception to all separate property owner retaining equity?

Answer: A separate property marital owner can protect the separate property residence by entering into a prenuptial or postnuptial agreement.

A prenuptial agreement is a legally binding contract signed before marriage outlining how assets, debts, and spousal support, if any, will be handled in case of divorce or death. A postnuptial agreement is similar to a prenuptial agreement but is signed after the marriage.

A separate property residence should be identified in a prenuptial or postnuptial agreement in order to protect the rights of the separate property owner.

Dallas High Asset Divorce Attorneys

Nacol Law Firm P.C.

(972) 690-3333

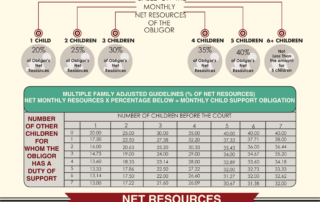

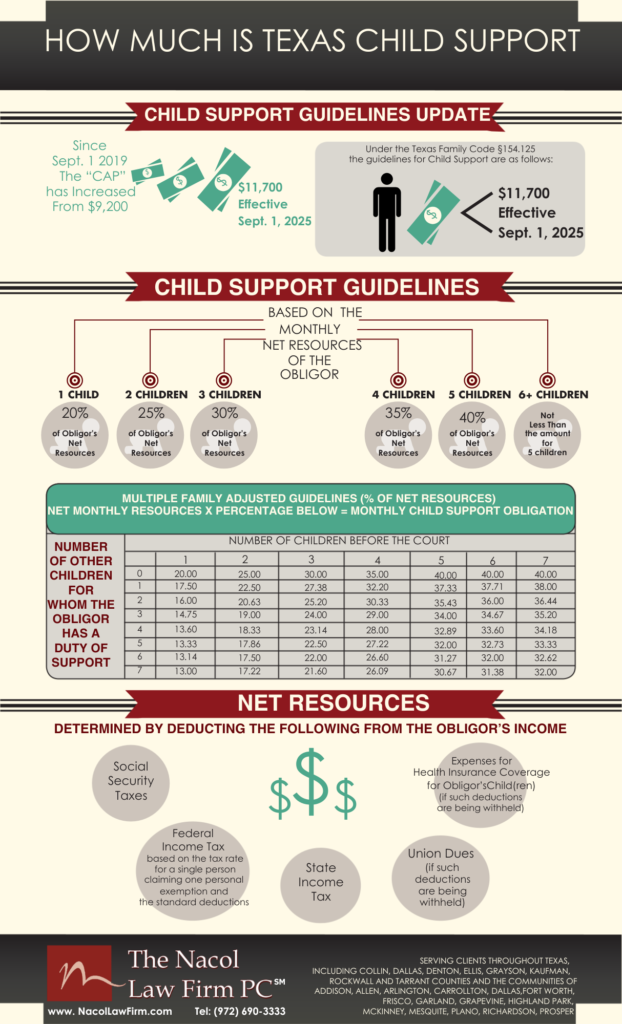

Texas Child Support Guidelines

UPDATE ON TEXAS CHILD SUPPORT:

A new cap is effective for all child support orders finalized on or after September 1, 2025

The Texas child support cap increased from $9,200 to $11,700 in net monthly resources for orders finalized on or after September 1, 2025, following legislative changes to the Family Code. This significant adjustment, part of the regular Texas child support guideline review, means higher guideline support amounts for higher-income parents. For example, the new cap results in a maximum monthly payment of $2,340 for one child (20% of $11,700) and up to $4,680 for five or more children (40% of $11,700) under the standard guideline framework.

Texas Family Code §154.125(a)(1) requires that every six years the presumptive amount of net resources to which the child support guidelines apply shall be reviewed and adjusted for inflation by the Texas Office of the Texas Attorney General (OAG). That section sets out the formula for doing so based on the consumer price index. The last adjustment was done in 2019 when an amount of $9200 per month was established.

How does the “cap” work and what could this mean for you? If your net monthly resources are less than $11,700, the child support obligation will not change on Sept. 1. You are under the “current cap” and lower than the “new cap”. All stays the same.

If you are currently going through litigation and your net monthly resources exceeds $11,700 and the Court orders child support prior to September 1, 2025, Texas Child Support Guidelines will mandate that the Court apply the appropriate child support percentage to the first $9,200 in net monthly resources based on the number of children. But, if the Court orders child support after September 1, 2025, it will apply the new appropriate child support percentage to the first $11,700 in net monthly resources.

Child support under the guidelines is determined by applying the applicable percentage, beginning at 20% for one child and increasing incrementally for each additional child, to the net resources amount. If a child support obligor has monthly net resources over $11,700, a party seeking above the guideline’s child support has the burden of proving to the court that additional support should be ordered according to factors set out in Texas Family Code §154.126.

Important to Know: The new “cap” increase of September 1, 2025 will not automatically increase the obligor’s existing child support obligation. Any change in child support standing before September 1, 2025, can only occur through the court with a modification order to increase the child support to the new “Cap” amount of $11,700. After September 1, 2025, any new suit for child support will be subject to the new “cap”.

Please review the Texas Office of the Texas Attorney General (OAG) website for a child support calculator for the new breakdown: https://csapps.oag.texas.gov/monthly-child-support-calculator

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite #1190

Dallas, Texas 75231

Nacollawfirm.com

NACOL LAW FIRM P.C.

8144 Walnut Hill Lane

Suite 1190

Dallas, Texas 75231

972-690-3333

Office Hours

Monday – Thursday, 8am – 5pm

Friday, 8:30am – 5pm

OUR BLOGS

SEARCH

JOIN OUR NETWORK

Attorney Mark A. Nacol is board certified in Civil Trial Law by the Texas Board of Legal Specialization