What happens if you die without a will in Texas?

When a person dies without having made a will, property passes according to the criteria described in the Probate Code. Many people falsely believe that a surviving spouse or parent would take all the deceased’s property, especially if the children are young. That is not necessarily the case. The Texas Probate Code provides as follows:

On the intestate (without a will) death of one of the spouses to a marriage, the community property estate of the deceased spouse passes to the surviving spouse if:

1) no child or other descendant of the deceased spouse survives the deceased spouse; or

2) all surviving children and descendants of the deceased spouse are also children or descendants of the surviving spouse.

On the intestate death of one of the spouses to a marriage, if a child or other descendant of the deceased spouse survives the deceased spouse and the child or descendant is not a child or descendant of the surviving spouse, one-half of the community estate is retained by the surviving spouse and the other one-half passes to the children or descendants of the deceased spouse. The descendants shall inherit only such portion of said property to which they would be entitled under Section 43 of the Texas Property Code. In every case, the community estate passes charged with the debts against it.

If a person dies intestate leaving no husband or wife, it shall descend and pass in parcenary to his children in the following course:

1) To his children and their descendants.

2) If there be no children nor their descendants, then to his father and mother, in equal portions. But if only the father or mother survive the intestate, then his estate shall be divided into two equal portions, one of which shall pass to such survivor, and the other half shall pass to the brothers and sisters of the deceased, and to their descendants; but if there be none such, then the whole estate shall be inherited by the surviving father or mother.

3) If there be neither father nor mother, then the whole of such estate shall pass to the brothers and sisters of the intestate, and to their descendants.

4) If there be none of the kindred aforesaid, then the inheritance shall be divided into two moieties, one of which shall go to the paternal and the other to the maternal kindred, in the following course:

To the grandfather and grandmother in equal portions, but if only one of these be living, then the estate shall be divided into two equal parts, one of which shall go to such survivor, and the other shall go to the descendant or descendants of such deceased grandfather or grandmother. If there be no such descendants, then the whole estate shall be inherited by the surviving grandfather or grandmother. If there be no surviving grandfather or grandmother, then the whole of such estate shall go to their descendants, and so on without end, passing in like manner to the nearest lineal ancestors and their descendants.

Where any person having title to any estate, real, personal or mixed, other than a community estate, shall die intestate as to such estate, and shall leave a surviving husband or wife, such estate of such intestate shall descend and pass as follows:

1) If the deceased have a child or children, or their descendants, the surviving husband or wife shall take one-third of the personal estate, and the balance of such personal estate shall go to the child or children of the deceased and their descendants. The surviving husband or wife shall also be entitled to an estate for life, in one-third of the land of the intestate, with remainder to the child or children of the intestate and their descendants.

2) If the deceased have no child or children, or their descendants, then the surviving husband or wife shall be entitled to all the personal estate, and to one-half of the lands of the intestate, without remainder to any person, and the other half shall pass and be inherited according to the rules of descent and distribution; provided, however, that if the deceased has neither surviving father nor mother nor surviving brothers or sisters, or their descendants, then the surviving husband or wife shall be entitled to the whole of the estate of such intestate.

There shall be no distinction in regulating the descent and distribution of the estate of a person dying intestate between property which may have been derived by gift, devise or descent from the father, and that which may have been derived by gift, devise or descent from the mother; and all the estate to which such intestate may have had title at the time of death shall descend and vest in the heirs of such person in the same manner as if he had been the original purchaser thereof.

No right of inheritance shall accrue to any persons other than to children or lineal descendants of the intestate, unless they are in being and capable in law to take as heirs at the time of the death of the intestate.

In situations where the inheritance passes to the collateral kindred of the intestate, if part of such collateral be of the whole blood, and the other part be of the half blood only, of the intestate, each of those of half blood shall inherit only half so much as each of those of the whole blood; but if all be of the half blood, they shall have whole portions.

No person is disqualified to take as an heir because he or a person through whom he claims is or has been an alien.

No conviction shall work corruption of blood or forfeiture of estate, except in the case of a beneficiary in a life insurance policy or contract who is convicted and sentenced as a principal or accomplice in willfully bringing about the death of the insured, in which case the proceeds of such insurance policy or contract shall be paid as provided in the Insurance Code of this State, as same now exists or is hereafter amended; nor shall there be any forfeiture by reason of death by casualty; and the estates of those who destroy their own lives shall descend or vest as in the case of natural death.

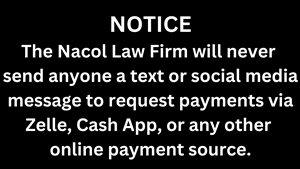

The Nacol Law Firm PC

Law office of Attorney Mark Nacol

Serving the Dallas / Fort Worth Metroplex for over 30 years

Tel: 972-690-3333